"When an industry with

a reputation for difficult economics meets a manager with a reputation for

excellence, it is usually the industry that keeps its reputation intact.” Warren Buffet

Contemporary Strategy Management

Strategy is the overall process of deploying resources to establish a favorable position.

Strategic Management---> Industry Analysis, Competitive positioning and Strategic Priorities.

1. Porter Analysis----> Give a picture of Industry Analysis----> Segmentation----> Give us the analysis of different Firms----> Resources and Capabilities-------> Firm level analysis.

The key challenge in industry analysis is to define the relevant industry- and it depends on how your customers perceive your product and how they are able to substitute with other products. Similarly on the supply side. e.g If Ambassador is replaced by luxury car by most of the customers then it is in luxury car segment.

The key success factors depends on two major parameters for industry:-

1. What the customer wants?

2. What does firm needs to survive the competition?

The percentage of US consumers loyal to a single brand varies from under 30% in batteries, 61% in canned vegetables and garabage bags-- This proves threat to entry.

CR4 Ratio tells us the market share of four largest producers.

http://www.amosweb.com/cgi-bin/awb_nav.pl?s=wpd&c=dsp&k=four-firm+concentration+ratio

2.

![]()

Porter view profitability as a return on capital relative to the cost of capital.

Competitor Analysis - Strategy View Point

These four parameters can play a vital role in determining what are the things should be considered while determining the framework for competitor analysis.

3. Cross Price Elasticity is higher in the group than between the groups because we have developed similar strategies therefore it is more substituted in the group. More commonality with in the groups.

Cross Price Elasticity=== % Change in demand of product A

% Change in Price of Product B

4. Strategic Group-> involves the same strategies- distribution channel, geographical depth, level of vertical integration.

5. Strategic Group Analysis vs Segmentation Analysis

6. The closer the strategic groups are the closer the price cross elasticity.

7. The ideas that we are developing can be equally applied to the Social Organisations

Economics of Scale

LRAC:- Long Run Average Cost

8. Reacting to problems is more dangerous than acting to the problems

In terms of analysis, strategic group is middle ground between firm and industry analysis.

The strategy analysis of market for cars in the US.

The groups that are defined are mass, luxury and ultra luxury and there are different set of variables that operate within the different strategic groups- The variability with in the strategic group is less as compared to the variability with in the strategic groups.

For strategic groups---> Define the market---> Do the strategy groups---> Select the products--->Perform the segmentation Analysis( Horizontal or Vertical)----> Choose the most profitable segment----> prepare the business plan

9. Strategic group are defined as a cluster of firms that have similar assets and employ similar strategies for key decision variables

10. A change in the environment can help to create a major strategic changes with in the firms in the industry.

11.Why is that important and how can we think about it?

12.PESTLE informs what are the forces are influencing the firms with in the country.

13.Porter helps us to

Describe our current success or failure in the industry.

Where we want to go ahead with the industry?

14. VRIO Analysis for analyzing outsourcing of activities

In technology industry the time frames are much shorter--for instance considering Outsourcing as a competitive advantage.

The ability to sustain competitive advantage lies on how you keep your competencies enclosed to you rather than competitor.

The problem in hand is to analyze what are the industry key success factors.

Why WalMart is so successful ?

Cost Drivers are:- Supply Chain, Inventory Holding, assembly; Sales and Marketing , Distribution.....

Dealer and Customer Support

Competitive Advantage

External factors:- In 1970's Toyota entered into US market to lure customers by offering small cars as compared to big cars in US. Ford and GM suffered badly at the hands of Toyota..

Internal Factors:- Create a whole new market and segments--->

-->Create a new customer segments

-->New Sources of Competitive Advantage

Imitation and Sustained Advantage

Mike peng on Institution Based View in Strategic Management

http://www.sciencewatch.com/dr/nhp/2010/10novnhp/10novnhpPengLE/

Culture Dimension Theory- Hofstede's work on Culture

Power distance index (PDI): “Power distance is the extent to which the less powerful members of organizations and institutions (like the family) accept and expect that power is distributed unequally.” Cultures that endorse low power distance expect and accept power relations that are more consultative or democratic. People relate to one another more as equals regardless of formal positions. Subordinates are more comfortable with and demand the right to contribute to and critique the decision making of those in power. In high power distance countries, less powerful accept power relations that are more autocratic and paternalistic. Subordinates acknowledge the power of others simply based on where they are situated in certain formal, hierarchical positions. As such, the power distance index Hofstede defines does not reflect an objective difference in power distribution, but rather the way people perceive power differences.

Individualism (IDV) vs. collectivism: “The degree to which individuals are integrated into groups”. In individualistic societies, the stress is put on personal achievements and individual rights. People are expected to stand up for themselves and their immediate family, and to choose their own affiliations. In contrast, in collectivist societies, individuals act predominantly as members of a life-long and cohesive group or organization (note: “The word collectivism in this sense has no political meaning: it refers to the group, not to the state”). People have large extended families, which are used as a protection in exchange for unquestioning loyalty.

Uncertainty avoidance index (UAI): “a society's tolerance for uncertainty and ambiguity”. It reflects the extent to which members of a society attempt to cope with anxiety by minimizing uncertainty. People in cultures with high uncertainty avoidance tend to be more emotional. They try to minimize the occurrence of unknown and unusual circumstances and to proceed with careful changes step by step by planning and by implementing rules, laws and regulations. In contrast, low uncertainty avoidance cultures accept and feel comfortable in unstructured situations or changeable environments and try to have as few rules as possible. People in these cultures tend to be more pragmatic, they are more tolerant of change.

Masculinity (MAS), vs. femininity: “The distribution of emotional roles between the genders”. Masculine cultures’ values are competitiveness, assertiveness, materialism, ambition and power, whereas feminine cultures place more value on relationships and quality of life. In masculine cultures, the differences between gender roles are more dramatic and less fluid than in feminine cultures where men and women have the same values emphasizing modesty and caring. As a result of the taboo on sexuality in many cultures, particularly masculine ones, and because of the obvious gender generalizations implied by Hofstede's terminology, this dimension is often renamed by users of Hofstede's work, e.g. to Quantity of Life vs. Quality of Life.

Long term orientation (LTO), vs. short term orientation: First called “Confucian dynamism”, it describes societies’ time horizon. Long term oriented societies attach more importance to the future. They foster pragmatic values oriented towards rewards, including persistence, saving and capacity for adaptation. In short term oriented societies, values promoted are related to the past and the present, including steadiness, respect for tradition, preservation of one’s face, reciprocation and fulfilling social obligations.

Indulgence, vs. restraint: Societies with a high rate of indulgence allow hedonistic behaviors: people can freely satisfy their basic needs and desires. On the opposite side, restraint define societies with strict social norms, where gratification of drives are suppressed and regulated.

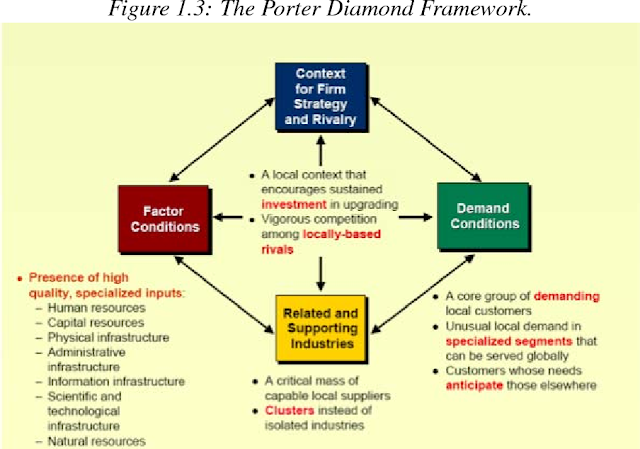

Porter Diamond Model- For understanding the determinants of national competitiveness.

Porter Value Chain Analysis- Secondary and Primary Activities for Sustaining Advantage

BCG Experience Curve

It states that the more often a task is performed, the lower will be the cost of doing it. The task can be the production of any good or service. Each time cumulative volume doubles, value added costs (including administration, marketing, distribution, and manufacturing) fall by a constant and predictable percentage.

Mathematically the experience curve is described by a power law function sometimes referred to as Henderson's Law:

where

1. Sources of Competitive Advantage

Cost Advantage----> Differentiation and Low Cost

2. Search goods:- In economics, a search good is a product or service with features and characteristics easily evaluated before purchase.e.g flowers

and experience goods:-Experience goods typically have lower price elasticity than search goods, as consumers fear that lower prices may be due to unobservable problems or quality. E.g. Electronic products

Differentiation and Product Life Cycle

System---> Commodization----> Decommodization---> System

Apple Differentiation Case

Design, User Experience, Packaging, Performance Issues, Retail Stores, -----> Competitive Advantage....

NUMMI Case

Are you capable to innovate and

GM and VW deconstruct this system in a modular fashion. This is a concern for chinese counterparts and they can replicate the technology in a modular fashion while there are inherent capabilities of Toyota is not easily replicated.

More concerned with products rather than process---> Process is really hard to replicate than the products.

Support from Japan is tremendously important for the success of NUMMI Case.-> Ongoing relation, Labor relations.

Geographical Scope

Product Scope

Market Scope

Transactional Costs

Price(A+B)< P(A)+ P(B)---> Why I would like to treat them a one continuity rather than separate activities..

Transactional Cost Theory: One important reason for explaining the existence of multinational companies is transaction costs and internalisation. According to the internalisation approach multinational companies arise because companies tend to internalise transactions for which the transaction cost in the market is high. One way to reduce the transaction costs is to carry out these transactions within one and the same company rather than between independent companies.In such an event, firms emerge as organisations that challenge the market as an alternative mechanism for governing transactions walmart - private labels

Transactional Cost of market Vs Administrative costs of firms

DeBeers Case

The top 15 perfume brands capture 80% of market while top 15 jewellery brands capture less than 15% of market share

Monopsony ---- One buyer

Mining---> Debeers--->CSO---> Wholesalers----> Retailers

Diamond is forever ---> They actually remove the secondary market--->

When to decide product diversification and geographic diversification?

The notion is how well positioned companies are there in operating the resources and capabilities--

Initially they are successful in the Indian context until you experience a cumulative experience -- You have economies of learning, economies of scale, economies of purchase

Inspection Problem--- Price of used car---->Price of Plum( Nice) and Price of Lemon( Raw care)

Plum= $2000 and P lemon= $1000

We usually pay $ 1500 for Plums---> What are the implications----> there are less no of plums compared to lemons--->

Buyer is really having a information asymmetric

This is a major issue in merger and acquisitions

Information Asymmetric as in case of Enron

Interaction Problem---> How to bring two assets together for which I may have paid the right price for it.

How to do strategic alliance that makes sense

Health Care Value Chain

Payers---> Fiscal Intermediaries--->Providers--->Purchasers----->Producers

(Govt) Insurance Hospitals Group Purchasing Drug Mfgrs

Companies

What Cardinal Health do

1. Assess their current situation

2. Strategic Fit and Organisation Fit

3.Retain Top Talent even after acquisitions as turnover rate is high

4.Cardinal maintains a full time acquisition team to improve the efficiency of new mergers and acquisitions and to detailed out the nuances of acquisitions...

Product and Geographic Diversification

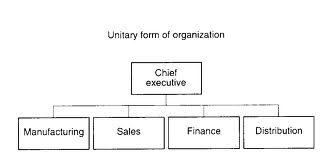

U - form structure of hierarchy

Each unit work as an independent unit capable of its all resources.

Matrix- form

Multinational strategies

Choice of Entry Modes

Cost Reduction and Localized Operations

![]()

Quadrant 1----> Transnational strategy----> Localized and cost responsiveness---->

Quadrant 2---->Commodity--> Global Standardization strategy---> Economy of scale, Economy of learning etc, EADS---> Parent company of Airbus( Because it is so expensive)

Quadrant 3-----> BMW, Luxury cars--->International Strategy---> Low cost and low pressure responsiveness

Quadrant 4-----> Lawyers, Consultants, Beers---> customizing services---> When does a Coca Cola has to do this?

Silo Effect:-

The "silo effect", popular in the business and organizational communities, refers to a lack of communication and common goals between departments in an organization. It is the opposite of systems thinking in an organization.

Avon ----> An example

http://www.in.avon.com/PRSuite/productdetails.page

A situation in which one participant's gains result only from another participant's equivalent losses. The net change in total wealth among participants is zero; the wealth is just shifted from one to another.

Triple Bottom Line----> People, Planet and Profits is the new mantra for corporates now....

Cable Network in US

Netflix---->

CSR - A model Business Logic of Sustainability- Ray Anderson Interface

Environmental Imapct= Population * Affluence* Technology----> Industrial Revolution

Environmental Impact= (Population* Affluence)/ Technology

Environmental Impact = (Population* affluence)

Conclusions:--

1. Increase in Quality generally adds more to profits than to the cost

Ultimate Strategy Maps

Loading............

For more check this out!! www.ashish-badyal.com

Contemporary Strategy Management

Strategy is the overall process of deploying resources to establish a favorable position.

Strategic Management---> Industry Analysis, Competitive positioning and Strategic Priorities.

1. Porter Analysis----> Give a picture of Industry Analysis----> Segmentation----> Give us the analysis of different Firms----> Resources and Capabilities-------> Firm level analysis.

Threat of new competition

Profitable markets that yield high returns will attract new firms.

This results in many new entrants, which eventually will decrease

profitability for all firms in the industry. Unless the entry of new

firms can be blocked by incumbents, the abnormal profit rate will tend towards zero (perfect competition).

- The existence of barriers to entry (patents, rights, etc.) The most attractive segment is one in which entry barriers are high and exit barriers are low. Few new firms can enter and non-performing firms can exit easily.

- Economies of product differences

- Brand equity

- Switching costs or sunk costs

- Capital requirements

- Access to distribution

- Customer loyalty to established brands

- Absolute cost

- Industry profitability; the more profitable the industry the more attractive it will be to new competitors.

Threat of substitute products or services

The existence of products outside of the realm of the common product boundaries increases the propensity

of customers to switch to alternatives. Note that this should not be

confused with competitors' similar products but entirely different ones

instead. For example, Pepsi is not considered a substitute for Coke but

water, tea, and coffee are.

- Buyer propensity to substitute

- Relative price performance of substitute

- Buyer switching costs

- Perceived level of product differentiation

- Number of substitute products available in the market

- Ease of substitution. Information-based products are more prone to substitution, as online product can easily replace material product.

- Substandard product

- Quality depreciation

Bargaining power of customers (buyers)

The bargaining power of customers is also described as the market of outputs: the ability of customers to put the firm under pressure, which also affects the customer's sensitivity to price changes.

- Buyer concentration to firm concentration ratio

- Degree of dependency upon existing channels of distribution

- Bargaining leverage, particularly in industries with high fixed costs

- Buyer volume

- Buyer switching costs relative to firm switching costs

- Buyer information availability

- Availability of existing substitute products

- Buyer price sensitivity

- Differential advantage (uniqueness) of industry products

- RFM Analysis

Bargaining power of suppliers

The bargaining power of suppliers is also described as the market of

inputs. Suppliers of raw materials, components, labor, and services

(such as expertise) to the firm

can be a source of power over the firm, when there are few substitutes.

Suppliers may refuse to work with the firm, or, e.g., charge

excessively high prices for unique resources.

- Supplier switching costs relative to firm switching costs

- Degree of differentiation of inputs

- Impact of inputs on cost or differentiation

- Presence of substitute inputs

- Strength of distribution channel

- Supplier concentration to firm concentration ratio

- Employee solidarity (e.g. labor unions)

- Supplier competition - ability to forward vertically integrate and cut out the BUYER

Ex.: If you are making biscuits and there is only one person who sells flour, you have no alternative but to buy it from him.

Intensity of competitive rivalry

For most industries, the intensity of competitive rivalry is the major determinant of the competitiveness of the industry.

- Sustainable competitive advantage through innovation

- Competition between online and offline companies

- Level of advertising expense

- Powerful competitive strategy

The key success factors depends on two major parameters for industry:-

1. What the customer wants?

2. What does firm needs to survive the competition?

The percentage of US consumers loyal to a single brand varies from under 30% in batteries, 61% in canned vegetables and garabage bags-- This proves threat to entry.

CR4 Ratio tells us the market share of four largest producers.

http://www.amosweb.com/cgi-bin/awb_nav.pl?s=wpd&c=dsp&k=four-firm+concentration+ratio

2.

Porter view profitability as a return on capital relative to the cost of capital.

Competitor Analysis - Strategy View Point

Next step is the segmentation and Segmentation is the pursuit of most profitable Customer to serve- Dell follows this strategy and always in look for most profitable segments

Steps in Segmentation Analysis

1. Identify key segmentation variables.

2. Reduce the no. of segmentation variables- Which one are more correlated and most significant?

3. Construct segmentation matrix- keeping strategic variables to different industry and apply five porter analysis

4. Identify key success factors in each segment.

5. Analyse the attractions of broad vs narrow segment scope.

Cross Price Elasticity=== % Change in demand of product A

% Change in Price of Product B

4. Strategic Group-> involves the same strategies- distribution channel, geographical depth, level of vertical integration.

5. Strategic Group Analysis vs Segmentation Analysis

6. The closer the strategic groups are the closer the price cross elasticity.

7. The ideas that we are developing can be equally applied to the Social Organisations

Economics of Scale

LRAC:- Long Run Average Cost

8. Reacting to problems is more dangerous than acting to the problems

In terms of analysis, strategic group is middle ground between firm and industry analysis.

The strategy analysis of market for cars in the US.

The groups that are defined are mass, luxury and ultra luxury and there are different set of variables that operate within the different strategic groups- The variability with in the strategic group is less as compared to the variability with in the strategic groups.

For strategic groups---> Define the market---> Do the strategy groups---> Select the products--->Perform the segmentation Analysis( Horizontal or Vertical)----> Choose the most profitable segment----> prepare the business plan

9. Strategic group are defined as a cluster of firms that have similar assets and employ similar strategies for key decision variables

10. A change in the environment can help to create a major strategic changes with in the firms in the industry.

11.Why is that important and how can we think about it?

12.PESTLE informs what are the forces are influencing the firms with in the country.

13.Porter helps us to

Describe our current success or failure in the industry.

Where we want to go ahead with the industry?

14. VRIO Analysis for analyzing outsourcing of activities

| Features of a Resource or Capability |

In technology industry the time frames are much shorter--for instance considering Outsourcing as a competitive advantage.

The ability to sustain competitive advantage lies on how you keep your competencies enclosed to you rather than competitor.

The problem in hand is to analyze what are the industry key success factors.

Why WalMart is so successful ?

Cost Drivers are:- Supply Chain, Inventory Holding, assembly; Sales and Marketing , Distribution.....

Dealer and Customer Support

Competitive Advantage

External factors:- In 1970's Toyota entered into US market to lure customers by offering small cars as compared to big cars in US. Ford and GM suffered badly at the hands of Toyota..

Internal Factors:- Create a whole new market and segments--->

-->Create a new customer segments

-->New Sources of Competitive Advantage

Imitation and Sustained Advantage

Mike peng on Institution Based View in Strategic Management

http://www.sciencewatch.com/dr/nhp/2010/10novnhp/10novnhpPengLE/

Culture Dimension Theory- Hofstede's work on Culture

Power distance index (PDI): “Power distance is the extent to which the less powerful members of organizations and institutions (like the family) accept and expect that power is distributed unequally.” Cultures that endorse low power distance expect and accept power relations that are more consultative or democratic. People relate to one another more as equals regardless of formal positions. Subordinates are more comfortable with and demand the right to contribute to and critique the decision making of those in power. In high power distance countries, less powerful accept power relations that are more autocratic and paternalistic. Subordinates acknowledge the power of others simply based on where they are situated in certain formal, hierarchical positions. As such, the power distance index Hofstede defines does not reflect an objective difference in power distribution, but rather the way people perceive power differences.

Individualism (IDV) vs. collectivism: “The degree to which individuals are integrated into groups”. In individualistic societies, the stress is put on personal achievements and individual rights. People are expected to stand up for themselves and their immediate family, and to choose their own affiliations. In contrast, in collectivist societies, individuals act predominantly as members of a life-long and cohesive group or organization (note: “The word collectivism in this sense has no political meaning: it refers to the group, not to the state”). People have large extended families, which are used as a protection in exchange for unquestioning loyalty.

Uncertainty avoidance index (UAI): “a society's tolerance for uncertainty and ambiguity”. It reflects the extent to which members of a society attempt to cope with anxiety by minimizing uncertainty. People in cultures with high uncertainty avoidance tend to be more emotional. They try to minimize the occurrence of unknown and unusual circumstances and to proceed with careful changes step by step by planning and by implementing rules, laws and regulations. In contrast, low uncertainty avoidance cultures accept and feel comfortable in unstructured situations or changeable environments and try to have as few rules as possible. People in these cultures tend to be more pragmatic, they are more tolerant of change.

Masculinity (MAS), vs. femininity: “The distribution of emotional roles between the genders”. Masculine cultures’ values are competitiveness, assertiveness, materialism, ambition and power, whereas feminine cultures place more value on relationships and quality of life. In masculine cultures, the differences between gender roles are more dramatic and less fluid than in feminine cultures where men and women have the same values emphasizing modesty and caring. As a result of the taboo on sexuality in many cultures, particularly masculine ones, and because of the obvious gender generalizations implied by Hofstede's terminology, this dimension is often renamed by users of Hofstede's work, e.g. to Quantity of Life vs. Quality of Life.

Long term orientation (LTO), vs. short term orientation: First called “Confucian dynamism”, it describes societies’ time horizon. Long term oriented societies attach more importance to the future. They foster pragmatic values oriented towards rewards, including persistence, saving and capacity for adaptation. In short term oriented societies, values promoted are related to the past and the present, including steadiness, respect for tradition, preservation of one’s face, reciprocation and fulfilling social obligations.

Indulgence, vs. restraint: Societies with a high rate of indulgence allow hedonistic behaviors: people can freely satisfy their basic needs and desires. On the opposite side, restraint define societies with strict social norms, where gratification of drives are suppressed and regulated.

Porter Diamond Model- For understanding the determinants of national competitiveness.

Porter Value Chain Analysis- Secondary and Primary Activities for Sustaining Advantage

BCG Experience Curve

It states that the more often a task is performed, the lower will be the cost of doing it. The task can be the production of any good or service. Each time cumulative volume doubles, value added costs (including administration, marketing, distribution, and manufacturing) fall by a constant and predictable percentage.

Mathematically the experience curve is described by a power law function sometimes referred to as Henderson's Law:

where

is the cost of the first unit of product

is the cost of the first unit of product is the cost of the nth unit of production

is the cost of the nth unit of production is the cumulative volume of production

is the cumulative volume of production is the elasticity of cost with regard to output

is the elasticity of cost with regard to output

1. Sources of Competitive Advantage

Cost Advantage----> Differentiation and Low Cost

2. Search goods:- In economics, a search good is a product or service with features and characteristics easily evaluated before purchase.e.g flowers

and experience goods:-Experience goods typically have lower price elasticity than search goods, as consumers fear that lower prices may be due to unobservable problems or quality. E.g. Electronic products

Differentiation and Product Life Cycle

System---> Commodization----> Decommodization---> System

Apple Differentiation Case

Design, User Experience, Packaging, Performance Issues, Retail Stores, -----> Competitive Advantage....

NUMMI Case

Are you capable to innovate and

GM and VW deconstruct this system in a modular fashion. This is a concern for chinese counterparts and they can replicate the technology in a modular fashion while there are inherent capabilities of Toyota is not easily replicated.

More concerned with products rather than process---> Process is really hard to replicate than the products.

Support from Japan is tremendously important for the success of NUMMI Case.-> Ongoing relation, Labor relations.

Geographical Scope

Product Scope

Market Scope

Transactional Costs

Price(A+B)< P(A)+ P(B)---> Why I would like to treat them a one continuity rather than separate activities..

Transactional Cost Theory: One important reason for explaining the existence of multinational companies is transaction costs and internalisation. According to the internalisation approach multinational companies arise because companies tend to internalise transactions for which the transaction cost in the market is high. One way to reduce the transaction costs is to carry out these transactions within one and the same company rather than between independent companies.In such an event, firms emerge as organisations that challenge the market as an alternative mechanism for governing transactions walmart - private labels

Transactional Cost of market Vs Administrative costs of firms

DeBeers Case

The top 15 perfume brands capture 80% of market while top 15 jewellery brands capture less than 15% of market share

Monopsony ---- One buyer

Mining---> Debeers--->CSO---> Wholesalers----> Retailers

Diamond is forever ---> They actually remove the secondary market--->

When to decide product diversification and geographic diversification?

The notion is how well positioned companies are there in operating the resources and capabilities--

Initially they are successful in the Indian context until you experience a cumulative experience -- You have economies of learning, economies of scale, economies of purchase

Inspection Problem--- Price of used car---->Price of Plum( Nice) and Price of Lemon( Raw care)

Plum= $2000 and P lemon= $1000

We usually pay $ 1500 for Plums---> What are the implications----> there are less no of plums compared to lemons--->

Buyer is really having a information asymmetric

This is a major issue in merger and acquisitions

Information Asymmetric as in case of Enron

Interaction Problem---> How to bring two assets together for which I may have paid the right price for it.

How to do strategic alliance that makes sense

Health Care Value Chain

Payers---> Fiscal Intermediaries--->Providers--->Purchasers----->Producers

(Govt) Insurance Hospitals Group Purchasing Drug Mfgrs

Companies

What Cardinal Health do

1. Assess their current situation

2. Strategic Fit and Organisation Fit

3.Retain Top Talent even after acquisitions as turnover rate is high

4.Cardinal maintains a full time acquisition team to improve the efficiency of new mergers and acquisitions and to detailed out the nuances of acquisitions...

Product and Geographic Diversification

U - form structure of hierarchy

Each unit work as an independent unit capable of its all resources.

Matrix- form

Multinational strategies

Choice of Entry Modes

Cost Reduction and Localized Operations

Quadrant 1----> Transnational strategy----> Localized and cost responsiveness---->

Quadrant 2---->Commodity--> Global Standardization strategy---> Economy of scale, Economy of learning etc, EADS---> Parent company of Airbus( Because it is so expensive)

Quadrant 3-----> BMW, Luxury cars--->International Strategy---> Low cost and low pressure responsiveness

Quadrant 4-----> Lawyers, Consultants, Beers---> customizing services---> When does a Coca Cola has to do this?

Silo Effect:-

The "silo effect", popular in the business and organizational communities, refers to a lack of communication and common goals between departments in an organization. It is the opposite of systems thinking in an organization.

Avon ----> An example

http://www.in.avon.com/PRSuite/productdetails.page

A situation in which one participant's gains result only from another participant's equivalent losses. The net change in total wealth among participants is zero; the wealth is just shifted from one to another.

Triple Bottom Line----> People, Planet and Profits is the new mantra for corporates now....

Cable Network in US

Netflix---->

CSR - A model Business Logic of Sustainability- Ray Anderson Interface

Environmental Imapct= Population * Affluence* Technology----> Industrial Revolution

Environmental Impact= (Population* Affluence)/ Technology

Environmental Impact = (Population* affluence)

Conclusions:--

1. Increase in Quality generally adds more to profits than to the cost

Ultimate Strategy Maps

Loading............

For more check this out!! www.ashish-badyal.com