If you are a decision-maker in the company, which is sitting with cash reserves, you are often perturbed, what to do with the free cash flow that is generated quarter over quarter. The cash, which is king, can put you in a spot. Many companies within the Indian ecosystem, is generating free cash flows. For instance, Infosys, TCS, ITC all have decent reserves

Essentially, there are two ways, in which one can deploy cash- Distribute or Retain- Give it back to shareholders or reinvest in the company.

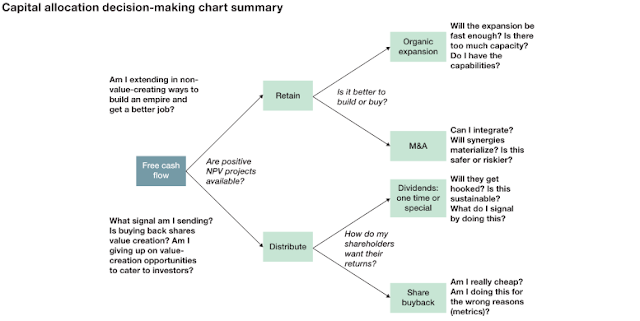

A simple framework below explains this:( Taken from How finance works- Mihir Desai)

So what are the trade-offs, hazards & fallacies?

Cash Retention: Only those new projects, should be taken, where NPV is +ve and there is a thorough scenario-based analysis for cash flow.

M&A takes away the risks of project completion, it has inherent risks( Sunpharma & Ranbaxy)

- Poor Due Diligence

- Expected Vs Real Synergies

- Accounting Practices

- Valuation Estimation

- Cultural Fit

Cash Distribution among shareholders

- Dividends

- Share Buyback

Which one is most effective, from shareholder's POV

In an ideal scenario, the net value of shareholder remains the same. The raw calculation is that both shares buyback and dividends are cash neutral. However, tax implications, asymmetric information, sentiments, and signals distort the value in both the scenarios in the real world.

The bottom line is that investment in the new projects, with +NPV and beating the cost of capital

is the sine qua non of finance

No comments:

Post a Comment